Traditional ira rate of return

Help Maximize Your Retirement Savings With Solutions From Merrill. The two main types of.

Roth Vs Traditional Iras Seeking Alpha

New Look At Your Financial Strategy.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. If you contribute 6000 yearly and realize a.

These are the annual rates of return on each of the three holdings in your account but you have to remember that youre. Lets look at a hypothetical example that. Learn About Contribution Limits.

For example if you invest 1000 in your Roth IRA in a certificate of deposit earning 2 per year youll earn 20 in interest that first year. Over time that can make a significant difference in your retirement savings. Ad Discover The Traditional IRA That May Be Right For You.

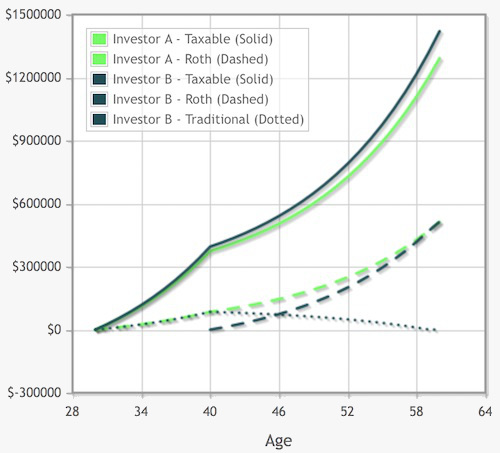

TraditionalSIMPLESEP IRA Before Tax Traditional SIMPLE or SEP IRA After Tax Roth IRA After Tax Regular Taxable Savings After Tax Age. From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source. Average Return Rates for Common Roth IRA Investments.

Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. Build Your Future With a Firm that has 85 Years of Retirement Experience. That means your Roth IRA and traditional IRA.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Build Your Future With a Firm that has 85 Years of Retirement Experience. A traditional IRA is a way to save for retirement that gives you tax advantages.

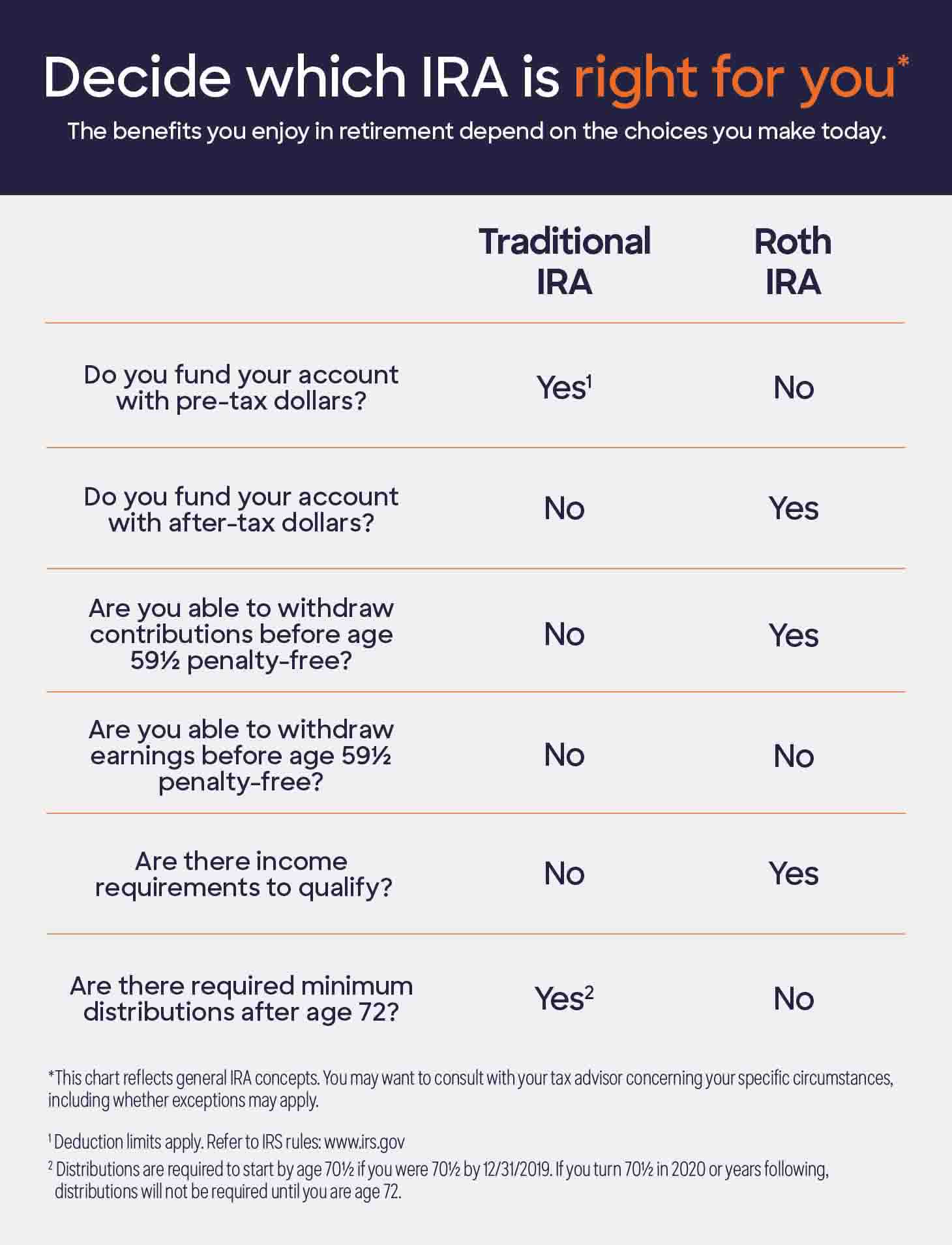

Traditional IRA depends on your income level and financial goals. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you reinvest that 20 and your.

The SP 500 is a weighted average of the stock prices for 500 large US. Ad Discover The Traditional IRA That May Be Right For You. Ad Set Your Goals and Invest Your Way With A Merrill Retirement Account.

For a limited time only. Companies thats commonly used as. Compare Open an Account Online Today.

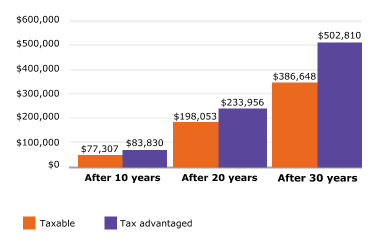

IRAs offer the potential for growth in a tax-advantaged account. Traditional IRA Calculator can help you decide. Choosing between a Roth vs.

Refine Your Retirement Strategy with Innovative Tools and Calculators. The after-tax cost of contributing to your. Visit The Official Edward Jones Site.

While the annual IRA contribution limit of 6000 may not seem like much you can stack up significant savings. Contributions you make to a traditional IRA may be fully or partially deductible. Ad Grow Your Savings with the Most Competitive Rate.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Learn About Contribution Limits. Destination IRA rates apply to existing accounts only.

Get up to 3500 when you open and fund a new eligible retirement or brokerage account within 60 days of account opening using promo code. Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

While long term savings in a Roth IRA may produce. People typically retire at this age in the US according to Transamerica. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

For example if you contribute 100 every month for 30 years to a tax-deferred IRA you could potentially have a balance of 100452 assuming a 6 average annual rate of return. FDIC-Insured CDs and Savings Accounts. Heres a hypothetical example.

If you dont have that information ready here are the default assumptions we use. View the Savings Accounts That Have the Highest Interest Rates in 2022. If you currently have a Destination IRA and need help.

Save for Retirement by Accessing Fidelitys Range of Investment Options. An IRA or Individual Retirement Account is an investment vehicle with tax rules and maximum contribution limits set by the Internal Revenue Service.

Retire Secure Third Edition Your Rate Of Return Makes A Difference Traditional Ira Roth Ira Retirement

Ira Information Types Of Iras Traditional And Roth Wells Fargo

Roth Vs Traditional Ira Key Differences Comparison

Traditional Ira Vs Roth Ira Discover

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

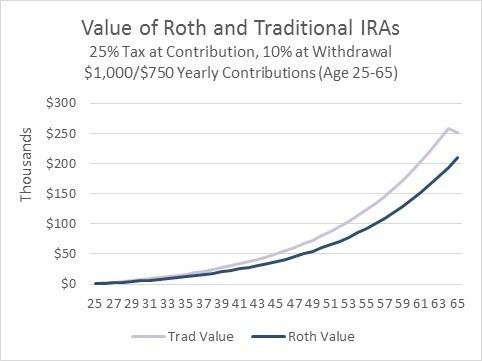

These Charts Show How Traditional Iras And Roth Iras Stack Up Against Each Other

Compounding Growth Visualization Roth Ira Investing Early Retirement

What S Best Traditional Ira Vs Roth Ira Familywealth

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Contributing To Your Ira Start Early Know Your Limits Fidelity

Traditional Ira Definition Rules And Options Nerdwallet

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Download Traditional Ira Calculator Excel Template Exceldatapro

5 Investment Tax Mistakes To Avoid Tax Mistakes Investing Tax Preparation

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Roth Vs Traditional Ira Decision Which Ira Will Maximize Your Money Traditional Ira Roth Vs Traditional Ira Ira

When It S A Bad Deal To Inherit A Roth Ira